4 Financial Statements Introduction

Similar to how a report card shows how a student is doing in school, a financial statement conveys an overview of the economic status of a business. It provides structured information about a company’s performance, resources, and obligations, allowing stakeholders to make informed decisions. Whether for investors evaluating opportunities, lenders assessing risk, or managers planning strategies, financial statements offer important insights into how a business operates and sustains itself. In this article, we will provide an overview of the four primary financial statements: the Balance Sheet, Income Statement, Statement of Cash Flows, and Statement of Retained Earnings.

Balance Sheet

The balance sheet presents a company’s financial position at a specific point of time by summarizing assets (economic resources controlled by the firm), liabilities (economic resources belonging to non-owners), and equity (economic resources belonging to owners). The fundamental equation providing the basis for the balance sheet is:

For instance, if a business owns $60,000 in inventory and has $25,000 in outstanding debt, the remaining $35,000 reflects the stockholder’s equity. This statement is crucial in assessing a company’s stability and ability to meet its financial obligations at a particular point in time.

Income Statement

The income statement measures a company’s financial performance over a period of time by reporting revenues, expenses, and the resulting net income or loss. Also known as the profit & loss statement or the statement of revenue and expense, it essentially highlights whether the company is profitable. The primary equation in this report is:

For example, if revenues significantly exceed expenses, we can conclude the company displays strong financial performance; however, recurring losses might signify underlying operational challenges. This statement offers insights into a firm’s profitability and efficiency, giving owners and investors the information needed for performance evaluation and strategic decision-making.

Statement of Cash Flows

The statement of cash flows explains how a company used and obtained cash during the account period by detailing cash inflows and outflows. It is organized into three categories: operating activities (day-to-day transactions), investing activities (purchases or sales of assets), and financing activities (debt and equity transactions). These categories form the overall structure:

This statement helps determine whether the company generates sufficient cash to cover expenses and fulfill financial commitments.

Statement of Retained Earnings

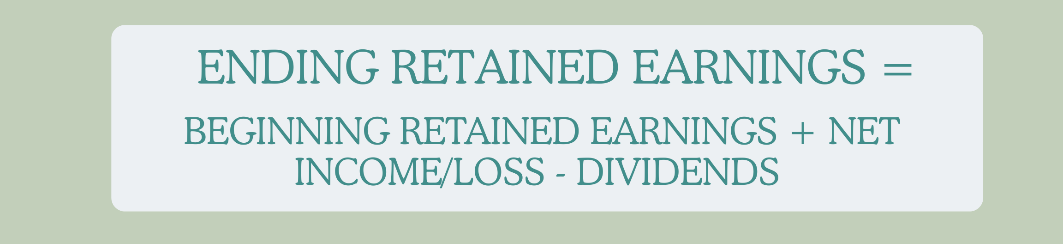

The statement of retained earnings explains changes in a company’s retained earnings balance over a period of time. It refers to historical profits earned by the company and how those profits are reinvested in the business and distributed. The four components in this document are beginning retained earnings, net income/loss, dividends, and ending retained earnings:

This statement bridges the income statement, which details profit, and the balance sheet, detailing equity, by linking profits to a company’s earnings and overall financial structure.

In this article, we introduced the four primary financial statements and their purposes. We take a closer look at each statement individually in separate articles to explore how they work and how to interpret them effectively.