Understanding an Income Statement

The income statement, also referred to as the profit and loss statement, is one of the most widely used financial reports because it summarizes a company’s profitability over a period of time. Instead of showing a snapshot at a point in time like the balance sheet, the income statement tracks activity over an accounting period to determine whether a company is making money. This statement is incredibly valuable for managers, investors and lenders when wanting to understand how efficiently a company is turning its operations into profit. To understand the three components of the balance sheet we will take a closer look at revenues, expenses, and net income (or loss).

Revenues

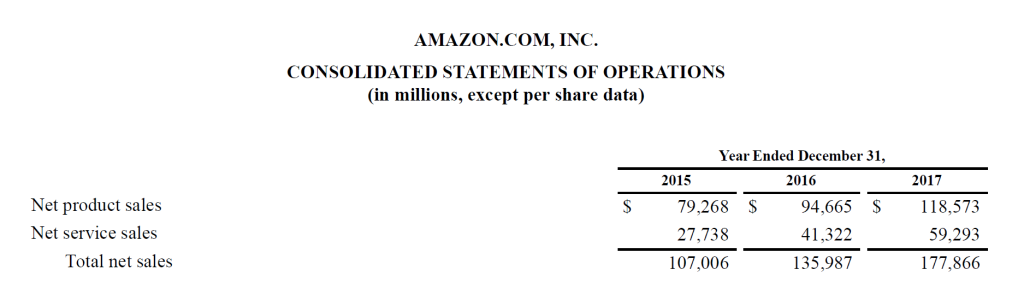

Also called sales or top line, revenue is listed at the top of the income statement. It represents the money a company earns from its core operations over a period of time and is an important indicator of company demand. Categories within revenue include net sales, service fees, licensing and subscription, and interest income. Many income statements also break these categories further into product lines or regions, so consumers can understand what is driving growth. Consistently growing revenues usually signal that a business is improving its market position; however, leveled or declining revenues may indicate operational or competitive challenges.

Expenses

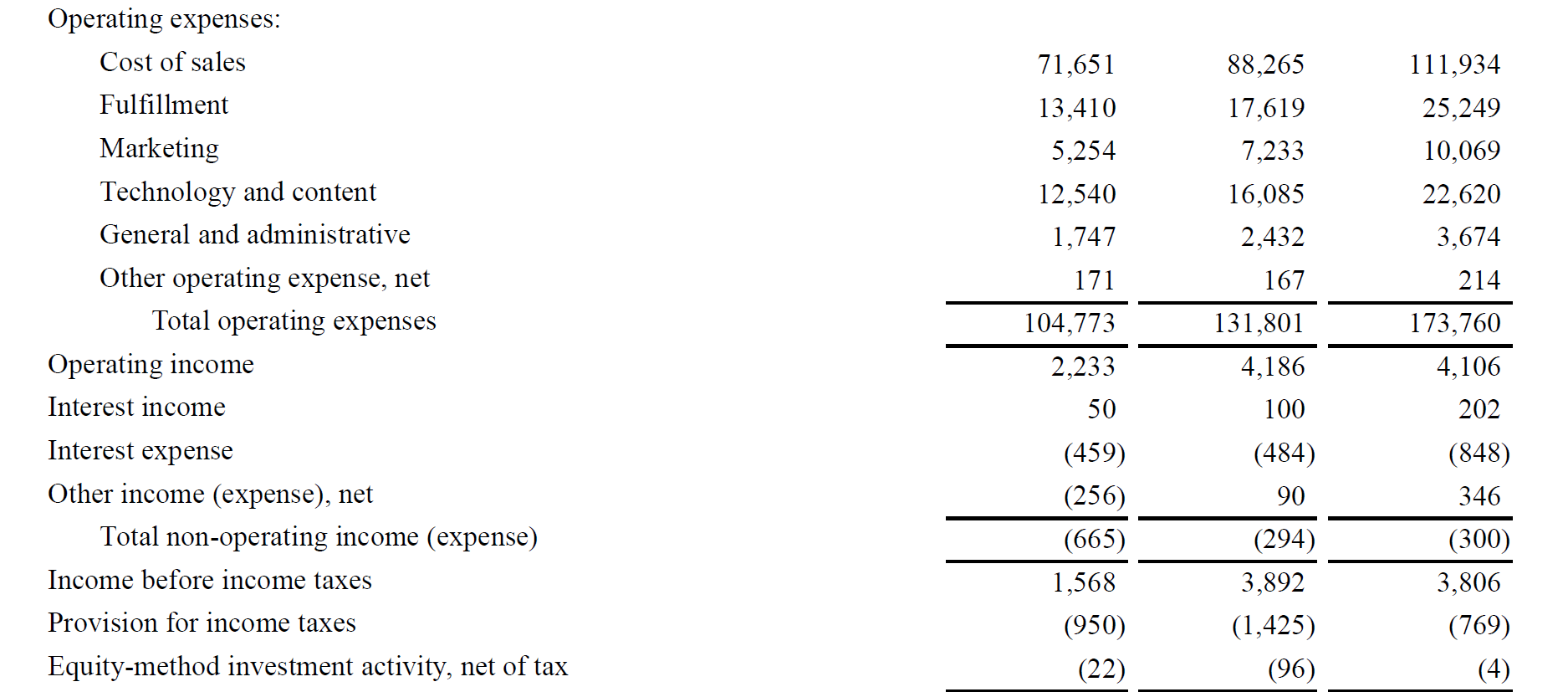

Expenses are listed next on the income statement and represent the costs a business incurs to generate their revenues. They are typically listed in the order they occur, beginning with cost of goods sold (COGS), which measures the costs incurred for producing goods and services. Next come operating expenses, which are the day-to-day costs incurred. This broad category is broken down into selling, general, and administrative (SG&A) expenses, costs related to sales, marketing, and administrative functions, and depreciation and amortization, expenses related to cost of long-term assets over time. At the end, non-operating expenses like interest expenses and income tax expenses are reported because they are not related to the company’s primary business operations. Tracking expenses helps decision-makers evaluate if spending is efficient and where cost-cutting might be necessary.

Net Income (or Loss)

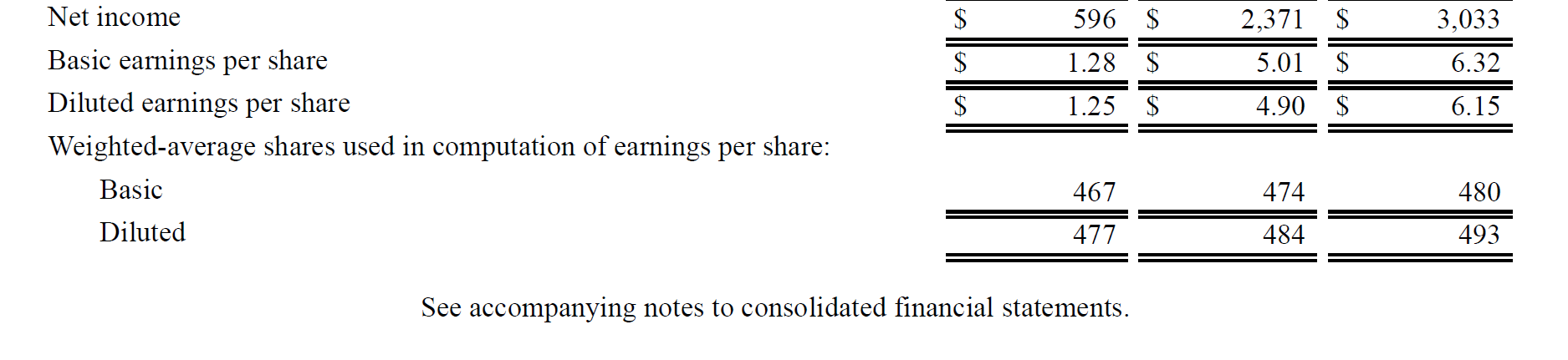

Net income or loss is calculated after subtracting expenses from revenues. Also known as the bottom line, a positive number indicates the company made a profit during the period, while a negative number reflects a net loss. This value is an important measure for investors since they can compare net income across periods and competitors to assess performance and profitability.

When reading an income statement, it is important to look for trends over time: Are revenues increasing faster than expenses? Is net income showing steady growth or is it fluctuating? Ratios like gross margin (gross profit/revenue) and net profit margin (net income/revenue) can help assess profitability more precisely and can be a clearer indicator of company trends.